- Home - News

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- Photo Archives

- News Headlines

- Press Release

General News of Thursday, 29 November 2018

Source: BFT

BoG won’t disclose your MoMo details — Governor assures

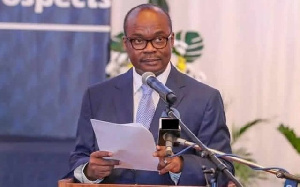

The central bank will not disclose details of customers’ mobile money transactions to any other party, its Governor Dr. Ernest Addison has said – affirming that customers’ privacy remains a fundamental right that must be protected.

The central bank’s position could throw a spanner in the works for the National Communications Authority, which is seeking to monitor telecoms sector revenues through its controversial Common Monitoring Platform.

Speaking at the launch of the second phase of the mobile money interoperability project, Dr. Addison said the Bank of Ghana remains sole regulator of the mobile money industry and as such will not volunteer details of customers’ transactions – as this would constitute a breach of privacy.

The Ministry of Communications, which has the telecoms regulator NCA under its supervision, gave an ultimatum to the mobile money companies (MTN Mobile Money, AirtelTIgo and Vodafone Cash) to allow their systems to be connected to by KelniGVG which manages the Common Monitoring Platform.

However, the latest remarks by the Governor not only reaffirm the Bank’s position as regulator of the mobile money industry but also shreds assertions made by the Communications Ministry to the effect that the mobile money industry comes under the NCA.

“As sole regulator of the Mobile Money sector, the central bank will ensure that right things are done by the various players in the sector. We will continue to regulate and monitor activities within the space, and ensure that all participants play by the rules,” the Governor said.

The Bank of Ghana has a key responsibility to safeguard the financial system’s integrity to underscore the trust that is central to financial deepening and development. It is therefore critical to ensure the confidentiality of transactions, privacy of data collected by operators in this space (including personal and financial data), the security of transactions, and smooth operations of all stakeholders and regulators providing complementary services in this space,’’ the Governor said.

Second phase

The first phase of the mobile money interoperability was launched in May this year, allowing mobile money transactions to be completed across different networks.

The second phase, which was launched yesterday by Vice-President Dr. Mahamud Bawumia, will enable interconnection between Mobile Money and the e-zwich Payment Systems.

Speaking at the launch, the Vice-President said interconnection of mobile money and e-zwich platforms to the gh-link platform means customers can conveniently move funds across all three platforms – bank accounts, Mobile Money wallets and the e-zwich payment systems.

“This is the universal interoperability that we call a Financial Inclusion Triangle, because it interconnects three payment platforms: mobile money, bank accounts and e-zwich…

“This should make us more efficient and enable us to accomplish more within the time available to us. All of these important initiatives are in sync with other programmes by President Nana Addo Dankwa Akufo-Addo’s government to quicken the digitisation of the economy,” the Vice-President said.

According to Dr. Bawumia, it has become necessary for industry players to take a second look at the ceiling placed on the amount of money that can be transferred daily via mobile money – in a way that ensures the security of the system is not compromised.

The Vice-President also proposed that the Ghana Interbank Payment and Settlement Systems (GhIPSS) should consider deploying a third phase of the project, which would ensure mobile money operator/agent/or merchant interoperability.

“By this, I mean that it should be possible for an operator, agent or merchant with one phone and SIM to be able to load electronic funds onto the wallet of the customer regardless of the network. I know the capability of GhIPSS, the Telcos, Bank of Ghana, fintechs and the Financial Institutions, and I have no doubt that this Phase-3 request will equally be executed with excellence,” he argued.

The interoperability platform’s performance has been impressive, based on the key pillars of convenience, accessibility and value for money.

Total transaction value and volume have increased from GH¢8.3million and 96,907 respectively in May 2018 to GH¢32.6million and 319,094 respectively in September 2018, representing 292.8 percent and 229.3 percent growth in value and volume respectively.

This growth trend is expected to increase further when the second phase becomes fully operational, and other innovative products and services become available.

Entertainment