- Home - News

- Polls

- Year In Review

- News Archive

- Crime & Punishment

- Politics

- Regional

- Editorial

- Health

- Ghanaians Abroad

- Tabloid

- Africa

- Religion

- Election 2020

- Coronavirus

- Photo Archives

- News Headlines

- Press Release

Politics of Monday, 22 November 2021

Source: classfmonline.com

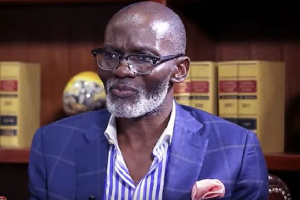

E-Levy: You want the country fixed, yet you are against raising revenue – Otchere-Darko

The former Executive Director of the Danquah Institute (DI), Gabby Asare Otchere-Darko, has said although Ghanaians want the country to develop, they are opposed to factors that can contribute to development.

His comments follow a current debate among the Ghanaian populace on the government’s proposed E-Levy.

According to the DI founder, Ghanaians are opposed to “raising revenue” to aid the country’s development.

In a tweet on Monday, 22 November 2021, the DI founder said: “Ghana’s development paradox. You say you want the country fixed. Yet, you are against raising revenue to get it fixed! Motives matter!”

Once the 2022 budget is approved, all electronic transactions in Ghana will attract an E-Levy, as part of moves by the government to shore up its revenue mobilization.

This was announced by Finance Minister Ken Ofori-Atta on Wednesday, 17 November 2022, when he presented the 2022 budget to Parliament.

He explained that the upsurge in the use of e-payment platforms due to the COVID-19 pandemic had been an impetus for introducing the levy.

As a result, Ghana recorded a total of GHS500 billion from e-transactions in 2020 compared with GHS78 billion in 2016.

He said: “It is becoming clear there exists an enormous potential to increase tax revenues by bringing into the tax bracket transactions that could be best defined as being undertaken in the informal economy.”

He noted, therefore, that the government is charging an applicable rate of 1.75% on all electronic transactions covering mobile money payments, bank transfers, merchant payments, and inward remittances, which shall be borne by the sender except inward remittances, which will be borne by the recipient.

However, Ghanaians, including the eCommerce Association and the minority in Parliament, have reacted to the proposed levy with the majority kicking against it.

The eCommerce Association has said the government’s recent introduction of an e-levy on all e-transactions would hurt e-commerce in the country.

The association said in a statement signed by Executive Director Paul Asinor, dated Thursday, 18 November 2021, that it has the “potential of eroding all the gains made by the government’s digitalization agenda” and could spark a “major U-turn to the government’s vision of a cash-lite economy”.

Additionally, the group said it could send the largely unbanked population back to the days of financial exclusion, have a negative toll on the use of digital payments as compared to the ‘cash is king’ era, slow down the development of e-commerce in Ghana, as most payments are made through mobile wallets and fintech platforms today and reduce online sales resulting in tax reduction to the government.

While the Member of Parliament for Ningo Prampram, Mr Samuel Nartey George, has described the E-levy proposed by the government in its 2022 budget statement as a “taxation Ponzi scheme designed to tax the same value of money multiple times.”

According to the opposition MP, the proposed e-Levy is a complete ripoff.

In a tweet on Saturday, 20 November 2021, the MP said: “The more I process the e-Levy, the angrier I get. It is a complete ripoff. It is a taxation Ponzi scheme designed to tax d same value of money multiple times.”

He added: “It is plain government thievery & I cannot vote to approve a budget that has that levy included. No!”

Entertainment