Business News of Friday, 8 April 2022

Source: ghanaguardian.com

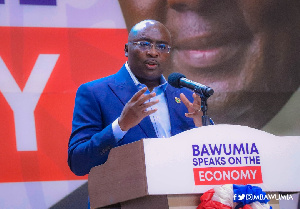

Coronavirus, banking sector clean-up cause of high debt stock – Bawumia

Vice President, Mahamudu Bawumia has attributed Ghana’s rising debt stock to the COVID-19 pandemic and the banking sector clean-up.

Addressing a National Tertiary Students Confederacy (TESCON) Training and Orientation Conference at Kasoa in the Central Region, Dr. Bawumia said the country’s debt to GDP ratio had “increased by 17.6 percent” between 2019 and 2021.

He posited that the economy would have fared better without these unexpected events.

“It should be noted that without the 15.1 billion of the exceptional items – the financial sector, and Covid, Ghana’s debt to GDP would have been about 68 percent instead of the current 80 percent,” the Economist said.

The Vice President indicated that some loans have gone into infrastructural projects.

“The projects that we have undertaken from the loans over the years, you will see that we borrowed to build the University of Environment Science and Sustainable Development, that is part of the debt, the Pokuase Interchange is part of the debts, the Tema-Mpakadan Railway is part of our debt, the Kumasi Airport Phase 2 is part of our debt, Tamale Airport is part of our debt.”

The COVID-19 pandemic adversely affected Ghana’s economy, resulting in a surge in the government’s expenditure by US$1.7 billion.

Although a few analysts have recommended that the government turns to external donors to facilitate the country’s recovery from a difficult financial situation, the government wants to raise revenue domestically to service Ghana’s debt.

The Vice President also acknowledged the negative impact the pandemic had on Ghana’s inflation rate.

“Inflation had declined from an average of 17.5% in 2016 to an average of 7.2% in 2020. Since the pandemic, inflation has increased to an average of 10% in 2021.”

He however indicated that interest rates are currently at a lower rate than they were in the 2013 -2016 period.

“Before COVID-19, the steady disinflation process provided scope for significant monetary policy easing. The Bank of Ghana’s Monetary Policy Rate (MPR) was cut by a cumulative 11% between January 2017 and January 2021.”

Ghana’s debt to GDP ratio currently stands at 78%.

View his Timepath below: