Business News of Friday, 17 December 2021

Source: thebftonline.com

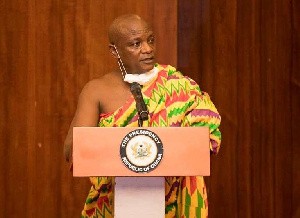

Togbe Afede reignites debate on high lending rate

Togbe Afede XIV, Agbogbomefia of the Asogli State, has expressed worry over the high lending rate situation in the country, urging Parliament to conduct investigations and possibly enact laws to deal with the matter, as he questions the banking industry and its regulator’s commitment to making loans affordable for businesses.

He said both the Bank of Ghana and commercial banks are not doing enough for borrowers and the economy at large, given that the regulator lends to banks at 13.5 percent while the banks lend at between 25 percent and 30 percent to the borrowing public.

Putting it in a global context, he said the United Kingdom is more indebted – with a debt of about 104 percent to GDP than Ghana, which is about 81 percent to GDP; yet, the rate at which the Bank of England lends to banks is currently 0.1 percent, while the Bank of Ghana lends to banks is at 13.5 percent – 135 times higher than the former.

“The UK GDP is US$2.7trillion, almost 40 times the size of our economy, which is US$72billion (GDP). But guess what? The Bank of England made a profit of £57million (US$76million) in 2020/21 – down from £72million (US$96million) in 2019/20. The Bank of Ghana, on the other hand, made a profit of GH¢1.57billion (US$270million) in 2020 – down from GH¢1.8billion (US$310million) in 2019.

Toge Afede XIV, who is a former board member of the Bank of Ghana, made this known when the Speaker of Parliament, Alban Bagbin, and some lawmakers paid a courtesy call on the traditional leader.

Many times, he said, the high indebtedness of government has been used to justify the situation. However, he thinks that government borrowing from the domestic market is not the root of the problem – but rather the profiteering nature of the regulator and commercial banks.

For him, the Bank of Ghana must focus on its mandate of contributing to macro-economic stability, growth and employment creation, rather than competing with commercial banks for profit.

On the part of commercial banks, he questioned why they earn so much from loaning out depositors’ funds, yet share very little of that profit with them.

“The banks are making incredible amounts of money from the high-interest rate environment at the expense of the people, industry, the private sector, government and at the expense of our growth. Why do we have to set interest rates so high?” he asked.

Toge Afede XIV, also took issue with how inflation is measured, saying: “Our current inflation rate, measured by the year-on-year change in prices (Consumer Price Index) as at October 31, 2021 (that is, October 31, 2021 vs October 31, 2020), is 11 percent.

“The Bank of Ghana’s prime rate is 13.5 percent. The insistence on keeping the prime rate above inflation is wrong. This inflation, in reality, is historical or past inflation; that is, the change in prices (Consumer Price Index) over the past year. Interest rate, on the other hand, is a forward-looking concept and is the cost of borrowing over the next one year".

“So, keeping Bank of Ghana’s prime rate at 13.5 percent – above the 11 percent (past) inflation is a self-fulfilling prophecy; and it inadvertently imports the high inflation of the past into the future. That is why we are trapped in this vicious circle of high inflation, high-interest rates,” he said.

He added, “Is it not odd that the Bank of England’s prime rate is 0.1 percent and the Bank of Ghana’s rate is 135 times that? How do you borrow, produce and compete with somebody producing from China or from England borrowing at much lower rates? It’s not possible".

“Hence, ours has always been high inflation and high-interest rate environment. If our bank rate is not the reason, what can the reason be? This wrong bank rate and consequential high-interest rates are themselves key factors in our inflation and our exchange depreciation".

“Parity laws easily explain this: You keep money in government bills and it grows, by say 20 percent, without any corresponding increase in production. That’s inflationary! That puts pressure on our currency.”

Opinions