Opinions of Thursday, 2 December 2021

Columnist: University of Environment and Sustainable Development, Somanya

2022 Budget Statement: What UESD academics think

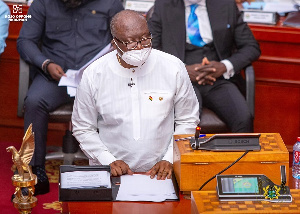

On November 17, 2021, the Minister of Finance presented the 2022 Budget Statement and Economic Policy of Government under the theme, “Building a Sustainable Entrepreneurial Nation: Fiscal Consolidation and Job Creation”. The content of the budget raised some concerns which have been widely discussed in the media. Academics at the University of Environment and Sustainable Development have also expressed their views to enrich the discourse.

Effects of the abolishment of road tolls on unemployment

Fatima Eshun (Ph.D.).

School of Natural and Environmental Sciences,

University of Environment and Sustainable Development, Somanya, Ghana.

The government as a social entity has a responsibility to create enabling environment for jobs and help its citizens to improve their livelihoods. The abolishment of road tolls announced in the 2022 budget seems to focus on increasing revenue generation as the government believes the revenue generated a year from the road toll is too small compared with the traffic and carbon emissions generated as a result. Instead, the government has introduced an E-Levy of 1.75%. This can help increase revenue since a greater proportion of the population engages in e-transaction and the government plans to enhance digitization in the country. However, some people in electronic transaction services are uncertain, and argues that this is counterproductive and may have implications on jobs. Others have also argued that this is approach is disincentive to the digitization drive and financial inclusion agenda. Already, those working in the road toll value chain have become unemployed, particularly those living with a disability. How does the government intend to provide jobs for this category of people and the many who have lost their jobs? What implications does this have on the informal sector? Would this increase the poverty gap? The government must assess the effects of this move on unemployment and provide sustainable measures to reduce unemployment in the country. In as much as taxes are generally good, its implementation must not be injurious to jobs.

Reflections on E-LEVY within the context of SDG 16

Prize McApreko (Ph.D)

School of Sustainable Development,

University of Environment and Sustainable Development, Somanya, Ghana.

Ordinarily, no one questions imperatives for strategically expanding revenue mobilization baselines capable of withstanding development demands imposed by population surge. The proposed introduction of e-levy therefore represents a smart and important step, especially given its hardly escapable wingspan. However, its most debilitating hallmark emerges when considered as a “replacement” for road tolls: an industry which has been cited severally for inefficiency, corruption and porous accountability. Policy makers and civil society anticipates robust attempts at regularizing these perceived associated irregularities. Since elements in the road toll and e-levy sectors are not comparable, the supposed “replacement” of the former with the latter is not convincing enough. This void denies the budget statement its opportunity to find harmony with UN SDG 16 on promoting peaceful and inclusive societies for sustainable development; providing access to justice, and building effective, accountable and inclusive institutions. Budget statements which prioritise bridging the yawning gap between proletariats and bourgeoisies while ensuring prudent use of state revenue would inure it to the pleasure of the populace. However, should the e-levy prevail with its present magnitude, would Government afford legislation against re-introduction of road tolls alongside e-levy by subsequent regimes? Otherwise, that will be unfair to the citizenry!

Creation of lifelong learning opportunities for all

Angela Kyerewaa Ayisi-Addo (PhD)

School of Sustainable Development,

University of Environment and Sustainable Development, Somanya, Ghana

Education equips citizens with relevant knowledge, skills and attitudes required for successful realisation of all 17 SDGs. Therefore, education should be considered as a major priority on most national agenda -facilitated by global initiatives like Education for All (EFA), and the Incheon Declaration and Framework for Action. Yet, many African countries suffer equity gaps between formal and non-formal education resulting from budgetary allocations. In 2018, while 17.6% and 29.3% budgetary allocation was made to Senior High Schools and tertiary levels respectively, only 0.3% and 1.3% respectively were allocated to the Non-Formal Education Division and the Council for Technical and Vocational Education and Training. In addressing this gap, the 2019 Complementary Education Agency Bill was passed in 2020 to provide learning opportunities and complementary education for out-of-school youth and adults outside the mainstream education system. Effort in the fiscal year 2022 to operationalize CEA Act 2020 and initiate processes for establishing multi-purpose Community Learning Centres in all 16 regions is a laudable intervention towards achieving SDG 4: “ensure inclusive and equitable quality education and promote lifelong learning opportunities for all”. Nonetheless, it deserves strategic multi-level collaboration among all relevant stakeholders.

The e-levy: minimizing the burden on the poor

Peter Asare-Nuamah (PhD),

School of Sustainable Development,

University of Environment and Sustainable Development, Ghana

In 2022, the Government of Ghana intends to charge a levy of 1.75% on all electronic transactions. While there’s no doubt that such a move will increase the tax base, it seriously has implications on financial inclusion and the economic status of the poor. Already, with the introduction of mobile money, evidence of existing charges points to robbing the poor. Without active participation in the formal banking sector, mobile money has offered financial inclusion to the poor, albeit with the burden of double payment as charges for transfers and withdrawals. E-levy will intuitively triple the burden for using mobile money. The approach adopted by Vodafone Ghana therefore, points to the fact that indeed mobile money transactions can be conducted at no cost to the customer. In this vein, currently, senders and receivers of Gh100 via Vodafone Cash enjoy zero rate charges while that of MTN Momo for the same amount stands at Gh2, for both transfer and withdrawal. With the introduction of the e-levy, Vodafone customers will pay Gh1.75 for just sending Gh100 or Gh3.5 for both sending and withdrawal, should the levy be applied at both sources. In the case of MTN customers, sending Gh100 would attract a charge of Gh2.75 and Gh5.5 for both sending and withdrawal, should the levy be applied at both sources. This, inadvertently, presents an alternative for customers to decide on which service to use for mobile transactions when the levy is implemented. However, the Regulator can minimize the burden on the poor by implementing a zero-rate charge across all networks, if possible. In doing so, the implications would be that the burden of paying 1.75% will loosely reduce to 0.75% for sending or 1.5% for both sending and withdrawals when compared to the current system with a charge of 1%. This approach will reduce the burden, especially on MTN Momo customers, who constitute the majority in the mobile money ecosystem in Ghana.

Reflections on Post- COVID-19 economic recovery for the 2022 budget.

Rexford Kweku Asiama,

School of Sustainable Development,

University of Environment and Sustainable Development, Somanya, Ghana

Ghana’s economy is rebounding after the shock of COVID-19, although the key sectoral driver has not been services as experienced in recent times. Surprisingly, data from the budget of 2022 shows that the agriculture sector has been resilient and contributed more growth since 2020, despite rising public debt levels and increasing demand for crude.

Therefore, Ghana’s economic recovery has resulted in government borrowing more to keep the economy afloat. The debt to GDP ratio is reported to be about 77%, which threatens long term growth prospects. The government has also made it clear that domestic revenue will have to be raised to sustain post- COVID-19 economic recovery. Hence, new tax measures have been announced in the 2022 budget towards raising enough revenue to support expenditure. In a recovery, it may not be too prudent to introduce new tax measures that may burden Ghanaians, in addition to relatively high prices of petroleum products.

Indeed, such measures beg the following questions about the budget for the 2022 fiscal year: To sustain long-term growth, should government raise tax revenue before stimulating spending in the economy? Can the economy grow if consumers pay more for petroleum products and taxes to clear the public debt or raise revenue? Governments can address these questions as part of their deliberations, given that the rate of rise in prices of petroleum products and its link to the fiscal policy measures is an area of interest to Ghanaians.

Acknowledgements: The authors are grateful to Prof. Eric Nyarko-Sampson (Vice-Chancellor), Prof. Edward Debrah Wiafe (Ag. Dean, SNES) and Prof. Anthony Amoah (Ag. Dean, SSD) for the initiative and encouragement.

Entertainment