Opinions of Monday, 10 July 2017

Columnist: Jacob Osei Yeboah

3% Flat Vat will benefit all

The issue on board is whether the 3% Flat VAT policy is helpful. And my answer is YES. It's beneficial to ALL.

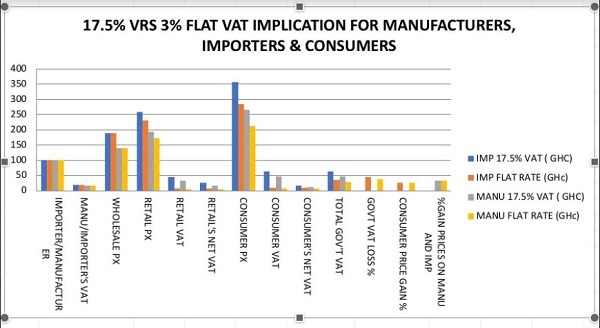

The 3% VAT policy is a step in the right direction by the NPP government as Local Manufacturers, Importers and Consumers will all benefit from its implementation. The analysis assumes Locally manufactured goods at a cost of GHc100 and CIF cost of GHc108.

The graph and the table attached depicts the government shedding off 45% and 38% of its 17.5% VAT revenues respectively for Imported and Locally Manufactured goods respectively when the 3% Flat VAT is implemented. Consumers on the other hand, will enjoy constant 25% reduction in prices of goods for both imported and locally manufactured goods when 3% Flat VAT is implemented accordingly.

All things being equal, the government does not lose revenue on 17.5% VAT application procedures. This is due to the fact that, Total VAT on consumers for 17.5% VAT is the same as the cumulative VATS of Importers or Manufacturers, Net Retails' VAT and Net Consumers' VAT at Ghc62.26 and GHc46.26 respectively. The government has therefore lessen the cumulative 17.5% burden on consumers' prices.

That is the same amount GHc62.26, for example which is the amount the Consumer pays as 17.5% VAT on goods ( at a price of GHc355.78) is the same amount as when you add Import VAT (18.90) plus net wholesale VAT (26.38) plus Net Retail VAT(16.98). These 17.5% VATs, all things being equal, the Consumer pays GHc 355.78 for goods. However, the consumer pays GHc284.70 when the 3% VAT is applied as per Govt policy.

The above analysis is based on a practical point of view of real time assumptions of 20% Return On Investment (ROI) for Manufacturers, Wholesalers and Retailers.

The prudence of this policy by H.E. Nana Addo is that, there is a likely high correlated ripple effects of high turnover and profits for Importers or Manufacturers as goods consumption will increase with decrease in prices of goods. AGI and Traders should rather be more grateful to the NPP government for the likely boost of the economy.

The analysis also calls for the government to endeavour to bring policies that can encourage competitive prices of locally manufactured goods in the country. Consumers are likely to enjoy a further 33.5% reduction in consumers' prices of goods manufactured in the country whether 17.5% or 3% Flat VAT is used. This further savings is due to exclusions on 20% Duty and 7.7% Import levies. That is why the one-district-one factory policy by the government should succeed at all cost.

Though there have been some arguments that the 3% Flat VAT is rather increasing the cost of goods when the analysis is done superficially without appreciating the cumulative 17.5% VAT that is added to consumers' prices of goods. The consumer finally bears the cost of VAT and so the 3% VAT finally will be less cumbersome in computation.

The consumer is the bottom line and how the policy trickles down to him/her should be the overarching goal of the government and key stakeholders.

Once the consumer pays less, the importer and wholesaler also recoup their funds with their interest. All benefit and so without any iota of mischief, the 3% VAT is better for all stakeholders. JOY2012