Opinions of Wednesday, 2 January 2019

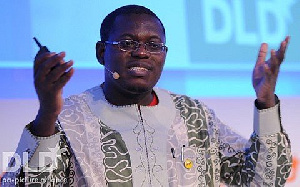

Columnist: Bright Simons

Bright Simons writes: The President of Ghana misfires on think tanks - Part II

In the first part of this two-part blog post, I introduced an argument that Government policies and projects are not the “branded products of the ruling government”, but rather techniques and processes that aid in the search for solutions to the problems of broad, inclusive, development. Consequently, such techniques can only be refined by the fire of constant probing for flaws, faults and opportunities for improvement.

I characterised states whose leaders encourage this iterative search for enhanced problem-solving methods in an open, collective, manner without misguidedly treating the solution-search as an end in itself, exclusively linked to their political parties and their re-election goals, as learning or apprentice states. On the basis of this logic, I criticised President Akufo-Addo’s remarks misconstruing policy critique by Think Tanks as “attacks”, “bombs” and distractions of “little substance”.

In this instalment of the blog post, I would like to draw attention to a few “grand policy frameworks” of the current government that have received poor scrutiny and are therefore lumbering from one rung to the other in search of a foothold. Notice that as far as my characterisation of policymaking is concerned, this tottering and lumbering is very natural. In fact, it is to be expected. Policies begin life as highly flawed instruments and are over time refined and recalibrated into more useful compasses to the aims we seek as a society.

The problem arises when policies are force-fed to the public through mass political marketing campaigns, treated as jewel-encrusted finished products fully birthed from the minds of genius leaders. Partisan praise-singers are then mobilised to quash intellectual dissent, shield the policies from the continuous refinement of forceful debate, and then slowly reduce these yet-to-find their feet instruments into living fossils.

One District One Factory

Such is the possible fate of the One District One Factory initiative should implementation continue without critical scrutiny at multiple levels.

First of all, the entire policy is based on long-held anxieties that without rapid, or even abrupt, industrialisation, Ghana is doomed. Some Government-favoured pundits talk about a spate of de-industrialisation that has rendered Ghana economically non-competitive, thus necessitating the establishment of factories in every corner of the country, on an emergency basis.

Many of the earnest framings of the issue are however neither backed by recent research and supported by the latest data nor reflective of the complex nuances on the ground.

The reality, in fact, is that the industry sector of the Ghanaian economy has been shown, following the careful work done during the rebasing effort, to have grown from 25.2% to 33.2%, whilst the share of the economy occupied by output in Services has declined from 56.2 per cent to 45.6 per cent.

Whilst there is considerable complexity in teasing out how the chaining of series from different base years impact the exact linking of the trends to particular periods, the simple conclusion is that the “de-industrialisation” bogey that continues to haunt policy is simply not what it has been painted to be.

Equally important is the fact of the shrinking services sector, which may actually point to more worrying undercurrents than our obsession with de-industrialisation. Contrary to the thrust of Government thinking over the years, it is Services, not manufacturing, that truly create jobs.

This is why as every country grows its economic capacity, services far outpace every other sector in terms of growth, sophistication and prominence. In virtually all the advanced industrialised countries, services constitute 70% or more of GDP, with an even greater impact on job creation. In South Korea, for instance, nearly 95% of all workers are dependent on the services sector according to some recent close-quarters studies. In Japan, the equivalent proportion is 82%. Even in Indonesia, China and India – long laggards in this trend – services is the fastest growing job-creation engine. creator of jobs

It is not all that difficult to understand the foundation of these trends. Manufacturing is becoming at one and the same time both highly automated (due to the greater role of precision technologies and digitisation) and highly dependent on auxiliary services (such as firmware embedded in the microelectronics at the heart of automotive components). For example, researchers have found that in the leading European manufacturing economies, services-oriented exports considerably outpace manufacturing-oriented exports in terms of overall value addition.

Researchers at Deloitte even estimated domestic value addition in manufacturing-based exports at less than 70% whilst service-based exports inch towards the 90% mark.

One major determinant in all of this is the quantity of imported inputs in manufacturing industries primed for export versus the intensity of local skills and know-how in export-oriented service sectors (such as software development and design). For example, Adjaye & Associates, the celebrated British architectural firm, contributes considerably to British exports without the need to import a lot of inputs due to the very nature of the design industries.

In the end, the real issue is “output”. Every economic activity can become high-output if the incentives exist for the right kinds of know-how and capacity to be created. Manufacturing can become an economy-draining affair, as indeed it became in the mid-sixties and throughout the seventies in Ghana due to distortions caused by a policy that bred serious inefficiencies.

What is fascinating however that in the same decade that we have seen manufacturing enterprises increased four-fold to nearly 100,000, even as the concurrent decline in competitiveness in the services sector has led to sluggish job-creation performance, we have suddenly zeroed in on a notion of “de-industrialisation” in order to justify a subsidy program for existing factories.

Clearly, the focus should not be on “factories” per se but on growing “capabilities” such as “design thinking”, “fabrication systems”, “standards conformity”, “modularity”, “six sigma” etc etc. that are cross-cutting in their effects and can boost productivity and efficiency across enterprises, whether in the manufacturing or services sector?

What is the point of scrambling around looking for subsidies to hand over to 254 manufacturing establishments on dubious criteria (how exactly did the current list of 79 “beneficiaries” come to be?) when we already have nearly 100,000 factories that are struggling to create jobs?

Even if you disagree with my conclusions, you surely would not argue that these are matters undeserving of much more debate than we have seen to date, would you? Would you call passionate suggestions for the improvement of the basic foundations of the 1D1F policy “substanceless”?

The Century Bond Saga

The Government of Ghana is mulling the issuance of 100-year bonds to finance important infrastructure projects.

The long maturity of these proposed instruments is being presented as beneficial for our debt sustainability.

Because Ghana’s public borrowing has consistently exhibited an “upward sloping yield curve”, we can be sure that this bond would be more expensive than the 30-year bonds we have been issuing. That is to say, instead of the 8.627% we paid for the latest 30-year bonds we issued, we may end up paying in excess of 10% for the coupon rate.

The impression one gets from reading government analysis of the proposed arrangement, at least from the snippets in which such analysis is usually dispensed in Ghana, is that by deferring payment of the principal for a hundred years, we automatically improve debt sustainability.

This “benefit”, unfortunately, is plainly ephemeral since our practice has been to “refinance” the bulk of our debts with new borrowing when the principal comes due. In that sense, our current long-term borrowing strategy amounts to a chain of debts, the character of which is not that dissimilar from the super-long-term arrangement we are currently proposing.

The difference – the very critical difference - however, is that we do not lock in interest rates for ridiculous lengths of time, and in recent rounds of refinancing we have been able to benefit from improved terms due to positive changes in the market.

A counter-argument that would most certainly be made is that we can embed a call provision in the bond-enabling us to refinance when rate conditions improve. Sure we can, but “callables” always come at any additional cost and they are almost never at-will, thereby limiting their flexibility.

The fact that routine debt servicing has been a bigger problem for us than principal redemption counsels against the use of super-longterm borrowing measures if it also means higher rates.

Once again, there could be alternative views justifying a completely different framing of the issue than that presented here, but who in their right mind can argue that:

We have had anything approaching a serious debate on this matter of a century bond;

Or that such a debate, exposing as many flaws in the design of the inchoate policy as possible, can be anything other than salutary for Ghana through the learning outcomes it can induce?

Why should criticisms, scrutiny, fault-pointing, flaw-probing, and even passionate disagreements over the direction of state policy as exemplified in the above two mini case studies excite anything other than careful examination among Ghanaian policymakers? Why should any President feel that these kinds of criticisms are distractions in the way of progress to be paid little heed or dismissed as “attacks” and “bombs” of “little substance”?

Would you consider it presumptuous if I were to say that President Akufo-Addo been grossly unfair to Ghanaian think tanks?