Opinions of Wednesday, 8 February 2017

Columnist: Hector Boham

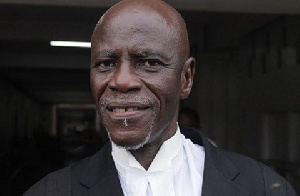

Challenges, solutions and strategies for Lawyer Akoto Apaw, incoming special prosecutor

The latest news coming from Ghana my motherland is that, President Akufo-Addo has settled on lawyer Akoto Ampaw as the first person to fill the position of Independent or Special Prosecutor.

Sources within the corridors of power have been talking about the respected lawyer. He is said to have defended media freedom and many people over human rights abuses.

He is characterized as having a deep knowledge of law and strong conviction about corruption and abuse of power.

Talking about the person that will ultimately fill the position, President Akufo-Addo had told the BBC that “…hopefully that person is going to be somebody who commands respect of the society and at the same time has an independent mind to make the decisions.”

“She-She” as Ampaw is warmly referred to by his close circles was part of the New Patriotic Party’s legal team during the 2012 election petition at the Supreme Court. He is a partner of Akufo-Addo’s law firm, Akufo-Addo, Prempeh & Co.

His latest case got the Supreme Court to order the EC to release collation sheets to the political parties prior to the December elections.

As the people of Ghana look forward in anticipation to the work ahead, it is the purpose of this article to shed light on some of the challenges, the renowned lawyer will face and the creative solutions he can pursue to counter them.

1) Tips from Whistleblowers especially Bank Workers (Ghana Whistleblowers Act - #720 of 2006 )

First, we should start making effective use of the Whistleblowers Act of Ghana. I do not know the rewards for whistleblowers but if there is no monetary incentive, then the law must be amended to give some predetermined amount of money to any tipster whose tip leads to the successful discovery of monies stolen from the Ghana government.

This will be great incentive to Bank workers. Here is a practical example - If I am a bank worker making 1000 ghs a month and I know of an ill-gotten wealth running into the millions of cedis (e.g. 3,000,000).

I will not care to risk my employment if by divulging information I can be assured of a decent percentage of the loot. For example if the percentage for the whistleblower is 3%. That means just from a phone call, a whistleblower could make 90,000 ghs – an amount which is more than his/her salary for more than 7 years.

This will be more than enough incentive for any potential bank worker whistleblower. Let us also remember that the whistleblower is going to be protected by the state and may even be assisted in finding an alternative job should his/her employers decide to let her go.

The Special prosecutor should be mindful of the glaring challenges he will face. It is a fact that more than a decade ago since the passing of the Whistleblower’s Act, hardly anybody has come forward with information. This is because many Ghanaians are afraid of retribution.

Even the fact that the law protects anonymity is countered by Ghanaians who say those apprehended can use spiritual methods to find out who gave them up and exact punishment which may also be in the spiritual realm. There is lack of training and legal proficiency on the part of prosecutors to effectively gather evidence and prosecute with success.

A research conducted by the Ghana Anti-Corruption Coalition (GACC), a civil society organization, revealed a litany of challenges. First the public has very limited knowledge about the Whistle Blowers Act 2006 (Act720).

Second apart from The Commission on Human Rights and Administrative Justice (CHRAJ), many of the mandated institutions at the regional level had not received any substantial training on the Act since it was passed. “These institutions also do not have clearly outlined processes and procedures for receiving complaints on whistle blowing,” the report stated.

In addition the public, including the media are not aware of their responsibility of handling whistleblowers’ report due to the competition of being the first to break the news.

Implementing institutions such as religious and traditional leaders are also aware of the Act but did not know the responsibility the Act provides in ensuring that they keep such information confidential otherwise they would be imprisoned.

Aside from the above challenges, the research also uncovered cultural issues as a hindrance for people to come forward to report on concerns; “The name ‘whistle blowing’ in our Ghanaian local languages is not encouraging and carries a negative connotation; “People have also indicated that even though whistle blowers’ identity may be protected others can use spiritual means to identify the person who reported the crime and harm them physically or spiritually”.

The research identified monetary awards as a major challenge as some people felt that reporting a crime should be a civic responsibility and not for monetary gains and others had raised concerns about the effectiveness of the proposed reward system and how it would be paid.

“Similar concerns have been expressed about the Board that manages the fund, there were no clear guidance on the timelines, and on when the rewards will be paid to the whistle blower after the prosecution to ensure that the whistle blower was not frustrated through this process.”

All these limitations can be summarily attributed to inadequate education and low level of awareness on the Act so the Special Prosecutor must stress the need to intensify education and awareness creation on the Act to ensure successful implementation.

The research recommended that a Legislative Instrument (LI) should be made for the Act to strengthen its implementation and designated institutions be made to create whistle blowers desks.

It also recommended that key officers in the public sector should be included in the training and awareness workshops to understand and appreciate the Act.

Ghana Money laundering Act of 2008 (Act 746)

There are two sections of the Money laundering Act of 2008 which will assist the Authorities working in collaboration with the banks, Bank of Ghana and the financial center to find any politician who conducted transactions through the banking system with his stolen funds.

These two sections are

Section 1.15 Maintenance of records

Section 1.16

Attention on complex and unusual large transactions.

These sections are described in detail in the boxes below. Their efficacy will be to make records readily available to Ghanaian authorities of any politician who has engaged in complex and unusually large transactions and that will be an excellent stepping stone to investigate if Ghana has been defrauded.

1.15 MAINTENANCE OF RECORDS ON TRANSACTIONS

(a) Financial institutions are required to maintain all necessary records of transactions, both domestic and international, for at least six (6) years following completion of the transaction (or longer if requested by the BOG and FIC in specific cases).

This requirement applies regardless of whether the account or business relationship is ongoing or has been terminated.

(b) Examples of the necessary components of transaction-records include customer’s and beneficiary’s names, addresses (or other identifying information normally recorded by the intermediary), the nature and date of the transaction, the type and amount of currency involved, the type and identification number of any account involved in the transaction.

(c) Financial institutions shall maintain records of the identification data, account files and business correspondence for at least six (6) years following the termination of an account or business relationship (or longer if requested by the BOG and FIC in specific cases).

(d) Financial institutions shall ensure that all customer-transaction records and information is available on a timely basis to the BOG and FIC.

1.16 ATTENTION ON COMPLEX AND UNUSUAL LARGE TRANSACTIONS

(a) Financial institutions shall pay special attention to all complex, unusual large transactions or unusual patterns of transactions that have no apparent or visible economic or lawful purpose.

Examples of such transactions or patterns of transactions include significant transactions relative to a relationship; transactions that exceed prescribe limits, very high account turnover inconsistent with the size of the balance or transactions which fall out of the regular pattern of the account’s activity.

(b) Financial institutions are required to examine as far as possible the background and purpose of such transactions and to set forth their findings in writing. They are required to report such findings to the FIC; and keep them available for BOG, FIC, other competent authorities and auditors for at least six (6) years

3) Bank Secrecy laws and Offshore accounts of political criminals

The third point is perhaps the most challenging for Ghana. In a US Report on Financial Havens, bank secrecy and Money laundering the point was made that finding, freezing and forfeiting criminally derived incomes and assets have become increasingly more difficult in recent decades because of the dollarization of black markets, financial deregulation, and the progress of the Euromarkets and the proliferation of financial havens.

The offshore financial world has been described as a “Bermuda Triangle” for the investigation of money laundering. Put simply the bad guys are winning and one can say the crooked Ghanaian politician who is savvy enough to send his/her stolen wealth to any of these financial havens may present a nightmare to investigators.

The report goes on to make this very damning statement "Money trails disappear, connections are obscured, and investigations encounter so many obstacles that they are often abandoned." And then states that advance in technology and communications have also made tracing money more difficult citing a "blurring of frontiers between legal and illegal economic activities."

The report points out that criminal money is usually held by corporations rather than individuals, and that the most important obstacle to investigations may be corporate secrecy laws. Shell companies are used in virtually all money- laundering schemes because they offer complete anonymity to owners. In many jurisdictions, they are not required to keep books or records.

But all is not lost. The UN is leading the charge and Ghana needs to partner with the UN Office of Drug Control and Crime Prevention. Certain proposals are in the pipeline such as tighter regulation of offshore banking and casinos, more efficient exchange of financial information between countries, improved training for financial investigators, increased controls over international business corporations and specially designed trusts, and a possible international convention on all outstanding privacy issues, including electronic information exchange and banking privacy.

The US is much more ahead in this fight and Ghana stands to benefit greatly by learning from their efforts. In 2010, the US passed The Foreign Account Tax Compliance Act (FATCA) which has begun to end bank secrecy and to require automatic information reporting of income earned by U.S. citizens in offshore investment accounts.

Moreover, recent commitments by Austria, Luxembourg, and Switzerland mark a beginning to the end of bank secrecy in Europe and movement toward automatic information reporting of income earned by European citizens in offshore accounts in European countries.

In addition, the G-8 and OECD have issued calls for world-wide automatic information reporting. It must be said that in spite of these hortatory calls, no concrete progress has yet been made toward ending bank secrecy and instituting automatic information reporting for the offshore accounts of citizens from developing countries outside the U.S. and Europe.

But that should not discourage us and we should continue to stand with all well-meaning nations of the world who are determined to fight this menace of society.

There is no doubt that there is a wind of change blowing and developing countries such as Ghana are the next port of call.

Good luck Mr. Special Prosecutor. Good Luck Mother Ghana