Opinions of Thursday, 4 February 2021

Columnist: Tobias Adrian and Fabio Natalucci

Financial perils in check for now, eyes turn to risk of market correction

“The vaccines are here!”—the cry heard and welcomed the world over—has boosted hopes of a global economic recovery in 2021. Yet until vaccines are widely available, the market rally and the economic recovery rest on continued monetary and fiscal policy support.

While there is for now no alternative to continued monetary policy support, there are legitimate concerns around excessive risk-taking and market exuberance.

Financial stability risks have been in check so far, but we cannot take this for granted.

Prices for stocks, corporate bonds, and other risk assets have risen higher on the news of vaccine rollouts. Financial markets have shrugged off rising COVID-19 cases, betting that continued policy support will offset any bad economic news in the short term and provide a bridge to the future.

As the apparent disconnect between exuberant financial markets and the still-lagging economic recovery persists, it raises the specter of a possible market correction should investors reassess the economic outlook or the extent and duration of policy backstop.

Unwavering faith

Reflecting unprecedented policy support, financial conditions have eased significantly last year, reversing the sharp tightening experienced during the March 2020 turmoil in most countries, thus supporting economic growth.

Despite rising COVID-19 cases, the stock prices of firms in sectors like airlines, hotel chains, and consumer services have rebounded as investors continue to move into these previously battered segments in search of good bargains.

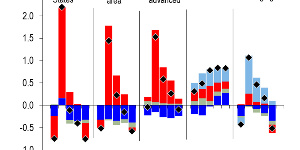

In advanced economies, credit spreads—the difference between yields on corporate bonds and comparable-maturity Treasury securities—have narrowed sharply both for higher- and lower-rated firms, close to or below levels that prevailed before COVID-19. Interest rates have reached record lows, lowering funding costs for firms, but also incentivizing investors to take on more risk as they search for higher returns on their investments.

Emerging-market countries and corporations have also benefited from the buoyant market sentiment, issuing bonds at record-high levels in 2020. Here too the difference between the yields on the sovereign and corporate debt of emerging-markets and U.S. Treasury securities has contracted sharply. And foreign investment in emerging-market financial assets (equities and bonds) has rebounded, providing more options for financing large debt-rollover needs in 2021.

The surge of COVID-19 infections and the associated public health restrictions imposed by governments since late 2020 may hurt economic activity in many countries. Yet investors appear optimistic about growth prospects in 2021, confident that policymakers will backstop financial markets along the path to recovery.

Bifurcated reality

Various analysts and investors continue to raise concerns that the true value of risk assets like stocks and corporate bonds seems out of line with market value. For example, they point to misalignments between (very high) equity market prices and valuations implied by (still weak) economic fundamentals, especially when considering the sizable economic uncertainties.

Other market participants, however, note that current market valuations can be explained after accounting for the “lower-for-longer” interest-rate environment.

As justification for the equity market rally, they point to expectations of very low interest rates for the foreseeable future (despite the most recent rise in long-term rates in the United States) and to upward revisions in corporate earnings expectations since the vaccine announcements.

They also mention the still relatively high volatility in equity markets as measured by the S&P500 VIX—a barometer of market sentiment—which one could expect to be lower if investors were indeed exuberant. Similar considerations about policy support have been made for credit markets.

Policy support remains crucial

Policymakers should safeguard the progress made so far and build on the rollout of vaccines to return to sustainable growth by preserving monetary policy accommodation, ensuring liquidity support to households and firms, and keeping financial risks at bay.

Reducing or withdrawing support at this stage could jeopardize the global economic recovery.

Exuberance and Complacency—how serious is the risk of a market correction?

While there is for now no alternative to continued monetary policy support, there are legitimate concerns around excessive risk-taking and market exuberance. This situation creates a difficult dilemma for policymakers. They need to keep financial conditions easy to provide a bridge to vaccines and to the economic recovery. But they also need to safeguard the financial system against unintended consequences of their policies, while remaining in line with their mandates.

With investors betting on persistent policy backstop, a sense of complacency appears to be permeating markets; coupled with apparent uniform investor views, this raises the risk of a market correction or “repricing.”

A sharp, sudden asset-price correction—for example, as a result of a persistent increase in interest rates—would cause a tightening of financial conditions. This could interact with existing financial vulnerabilities, creating knock-on effects on confidence and jeopardizing macro-financial stability.

Financial stability risks have been in check so far, but action is needed to address vulnerabilities exposed by the pandemic. These include rising corporate debt, fragilities in the nonbank financial institutions sector, increasing sovereign debt, market access concerns for some developing economies, and declining profitability in some banking systems.

Policymakers need to use this time to safeguard financial stability by employing macroprudential measures (for example, stricter supervisory and macroprudential oversight, including targeted stress tests at banks and prudential tools for highly levered borrowers) and developing new tools as needed. For example, policymakers are considering whether the macroprudential framework for nonbank financial institutions may need to be strengthened to address weaknesses that became apparent during the March turmoil.

Tackling vulnerabilities through these policies is crucial to avoid putting economic growth at risk and to prevent financial instability from disrupting the global economy

Entertainment