Opinions of Wednesday, 29 July 2020

Columnist: Yaw Asante

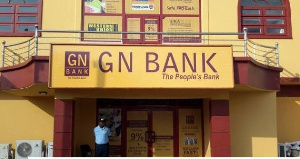

GN Bank: The dam that channeled deposits into shareholders’ pockets

I have sighted a press release from GN Corporate Affairs which sort to respond to an indirect statement by the Finance Minister. I have also heard Bishop Agyinasare asking whether GN Bank could not be saved. By the end of this brief write up, readers will indeed know that the collapse of GN Bank was inflicted by the ultimate shareholder, PK Nduom, who doubled as Director of the bank.

Dear Bishop Agyinasare, Duffour admitted using uniBank’s money to acquire properties

The woes of GN Bank began when it decided to finance its illiquid sister company, Gold Coast Securities, which was struggling to meet regular customer withdrawal requests. GN Bank’s recent financial statements showed that out of its nearly GHc 1 billion total assets, related parties had been given over GHc300 million in the form of loans, overdrafts, and placements. Meaning over 30% of the bank’s resources had been dished out to related parties in clear breach of the banking law.

The banking law says related parties should not take out more than 25% of shareholders' capital. Recent figures show shareholders’ capital was a little over GHc120 million. Meaning, the maximum amount of shareholders could have advanced to themselves was GHc30 million. Yet, Nduom presided over this clear breach by advancing 10 folds (GHc30 million x 10 = GHc300 million) to Gold Coast Securities and many other Groupe Nduom businesses, which were not being operated profitably anyway. Most of his investments in TV and radio stations did not generate revenue sufficient to even pay their salaries. Yet the Bank was used to finance most of its properties and equipment purchase.

If Bishop Agyinasare were the BoG Governor, what would he have done? How can you start a bank with GHc120 million, then take out GHc300 million, and still insist the bank belongs to you. Depositors’ funds are not free money and I hope Eric Nipa has already initiated court action to recover those advances to shareholders which were not being repaid, while poor borrowers were having their assets confiscated and sold and some being published in newspapers.

The government did not owe GN Bank. GN Bank benefited from liquidity support from BoG. Government rather owed a few contractors who in turn owed GN affiliates, which then promised part of those monies to GN Bank. Nduom, as an expert, knows the risks associated with lending to a group of connected borrowers who source their revenue from the government. Yet, they proceeded to do that against sound lending principles.

Finally, Nduom opened 300 locations but refused to put in adequate checks to ensure things were being done rightly by branch managers who were barely being paid. We all heard of several fraud cases by the staff of the bank who stole millions. In one such incident, one branch manager stole over GHc400,000. That amount was more than 50% of the last profit of the entire GN Bank. Most of the branches were not profitable anyway, which explains why the bank barely made any profits.

The high number of locations was not sustainable, and in fact, GN Bank itself came to that realization too late in the day as they began closing some branches. Too little too late.

Before its eventual collapse, there were several reports of customers not being able to withdraw money, of course, because shareholders and related companies were keeping those funds. Hence, a person could deposit money on a Friday, but cannot access it the next Monday, because their deposit would be given to someone else. If this was not a Ponzi Scheme, what else was it?

Entertainment