Opinions of Saturday, 15 May 2021

Columnist: Yusif Geoffrey

Islamic finance is a tool to promote equitable economic transformation in Ghana

Introduction

Ghana’s fast-growing economy is one of the best in Sub-Saharan Africa and there is therefore the need to position it as a well-diversified economic model.

One way to achieve this feat is to adopt Islamic finance as most major world economies have introduced the model to diversify funding for the national budget and as a boost for the domestic economy.

Islamic Finance has been in existence since the early days of Prophet Muhammad (Peace be upon him) and remerged in the modern global finance space in the early 1960s but came into the lime light during the 2008 global financial crisis.

This was because financial assets managed with Islamic Finance were largely not affected. Global Islamic Finance assets are forecast to reach USD 3.69 trillion by 2024, according to the 2020 Islamic Finance Development Report.

This article seeks to present an overview of Islamic Finance to the average Ghanaian and how a country like Ghana can harness its potential for the development and growth of the economy.

What is Islamic Finance?

Islamic Finance is the application of Islamic jurisprudence which derives its main sources from the Qur’an and sayings of the Prophet Muhammad (Peace be upon him) in raising and spending money.

The principles of Islamic Finance are also consistent with other revealed scripture like the Holy Bible and Jewish scriptures. Islamic finance, despite its name, is not a religious product.

Principles of Islamic Finance

The structure of Islamic finance revolves around the prohibition of any return derived on a loan /debt (riba) and the legality of profit. This implies that all financial transactions must be representative of real transactions or the sale of goods, services, or benefits.

In addition, Islam has also prescribed a moral / behavioral standard that is almost common in all civilized societies of the world. Below are fundamental principles of Islamic Finance

Avoiding Interest

Avoidance of interest is at the very heart of the philosophy of Islamic Finance. For this reason, God Almighty declared a war against those who consume interest in both the Quran and the Bible.

Relevant verses are as follows: “O you who have believed, fear Allah and give up what remains [due to you] of interest, if you should be believers. And if you do not, then be informed of a war [against you] from Allah and His Messenger.” (Quran 2-278-9).

Interest is also prohibited in other revealed scriptures for example in the bible (Exodus 22:25–27)

Interest is defined by scholars of Islamic jurisprudence as any return derived on a loan/debt (Ayub, Introduction to Islamic Finance). Islamic banks will not take or give any loan or enter contracts seeking any increase over the principal of loans or debts created as a result of any credit transaction.

Avoiding Gharar

Gharar refers to entering a contract in absolute risk or uncertainty about the ultimate result of the contract and the nature and / or quality and specifications of the subject matter or the rights and obligations of the parties.

Deceit, fraud, or deliberate withholding of value-relevant information is tantamount to Gharar.

Avoiding Maisir

Maisir means the game of chance – one gains at the cost of other(s); a person puts his money or a part of his wealth at stake wherein the amount of money at risk might bring huge sums of money or might be lost or damaged.

This prohibition is rooted in the Quran when the Almighty God said: “O you who have believed, indeed, intoxicants, gambling, [sacrificing on] stone altars [to other than Allah], and divining arrows are but defilement from the work of Satan, so avoid it that you may be successful.” (Quran 5: 90)

No Investment in prohibited industries

This principle requires investors to put their areas of the economy not prohibited by the shariah – Islamic law.

These areas are mostly harmful to the wellbeing of the society. They include pornography, prostitution, alcohol, pork, hard drugs etc.

Modes of Islamic Finance

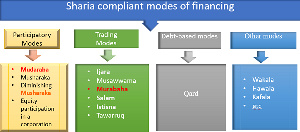

Islamic Finance uses various modes of finance to achieve the objectives of Islamic jurisprudence which is to seek utmost preservation of the wealth of all participants in an economy irrespective of their religious preference.

These modes ensure fairness and justice on the part of providers of funds and those who use these funds. The diagram below shows the various modes of financing in Islamic Finance.

Participatory modes are structured based on partnership. The two most common modes are the “Mudaraba and Musharaka.”

Mudaraba

This is a profit partnership whereby one party provides capital and the other provides labor and profit from the outcome of the business is distributed among the parties per an agreement. (AAIOIFI STANDARDS).

This can be used to finance for instance a bakery shop where one party provides funds for the establishment of the bakery and the other operates with his skills

Musharaka

Under this arrangement, there is also a joint venture where two or more people pool resources together to create a business and share in the profits and loss.

This mode can be used to finance the establishment of a farm where the parties share the profit and loss.

Trading modes are structured using trading, that is buying and selling of an underlying asset which must be shariah compliant. Below are the most common modes under this heading.

Murabaha is an example of trade-based contracts. It is a kind of sale in which the buyer knows the price at which the seller obtained the object to be traded and agrees to pay a premium over that initial price.

This can be used to the purchase of grains for market women where the grains are sold to them at mark up and payment is made later

Ijara is a lease-and-purchase transaction; a financing mode used by practitioners of contemporary Islamic finance in which a financier purchases reusable merchandise (e.g. airplane, buildings, cars) and then leases them to clients in return for an agreed upon rental fee (to be paid for the length of the lease period).

Most of the airplanes of Emirates Airlines are financed via the concept of Ijara.

Sukuk refers to investment certificates which documents the interest in ownership of tangible assets, usufructs and services or investment in the assets of projects or special investment activity that adhere to the principles of Shariah.

Ghana can use Sukuk to finance the construction of a railway from Accra to Paga without increasing our debt stock.

Misconceptions about Islamic Finance

Islamic finance is an alternative for conventional financial transactions. Although based upon ethical and social values of the Islamic faith, it shares the same economic objectives as more conventional products.

Islamic financing is available to Muslims and non-Muslims

Adopting Islamic Finance will lead to Islamization of the country and acceptance of shariah. This is not the case as most western countries have adopted Islamic Finance and have not become Islamic countries.

Former British Prime Minister David Cameron is quoted by the BBC (29 October 2013) when he pledged to make London one of the world's "great capitals of Islamic finance."

Benefits of Islamic Finance to the average Ghanaian

The average Ghanaian can benefit from various financing models described above instead of entering debt-based transactions which have proven to put a lot of burden – both economic and psychological – on borrowers.

A taxi driver can use an Ijara to finance the purchase of a cab compared to a straight loan.

Benefits of Islamic Finance to Businesses in Ghana

On businesses there is evidence from research in neighboring Nigeria that Islamic finance recorded higher returns on investment due to the participatory nature of its models and modes of management.

Banks will also reduce non-performing loans if not eliminate it from their books when they adopt and effectively manage Islamic finance products and services.

Benefits of Islamic Finance to Ghana as a country

The Ghanaian economy will be the greatest beneficiary of the introduction of Islamic Finance.

Firstly, the introduction of Islamic finance will project Ghana as a true destination for investment in the West African sub-region by attracting investment from the Gulf countries that control the lion shares hydrocarbon resources in the world.

Saudi Arabia for instance is looking for viable investment options across the globe and adopting Islamic Finance will position Ghana as a major beneficiary.

The way forward to establish Islamic Finance in Ghana

Ghana has made some progress in her bid to adopt Islamic Finance. The banks and Specialized Deposit Taking Act, 2016 (ACT930), section 18 1 under permissible activities has non- interest banking, all that is required now is a regulation to administer the sector.

There is also the need for a national policy on Islamic Finance as banking is not the only component of Islamic Finance. There are other sectors such as insurance, pensions and the capital market, which will grow with the adoption of Islamic Finance.

Conclusion

Islamic Finance is an emerging force globally and Ghana stands a greater chance of benefiting because adopting it will create a well diversified economy and fortify the country against global economic shocks.

Entertainment