Opinions of Saturday, 13 October 2018

Columnist: Martin Luther Akor

Menzgold, ‘NAM-Maths’ and the Ponzi Scheme

The last time we had an encounter, we did our possible best to see the striking similarity between NAM1 and his ‘son’ Ponzi but almost never talked about the interplay between Menzgold, Ponzi and the SEC. It would have been most ideal to tackle the latter issue in this piece. However, I found it quintessential to answer the most relevant question on the minds of some Menzgold clients who may still be standing with their 1 district 1 factory. To wit, why is Menzgold a Ponzi Scheme? In fact, in addressing this concern, I intend to just make a quick summary in order not to peeve some aggrieved members of the public who didn’t hesitate to voice their frustration on the earlier post, titled NAM1 the father, Ponzi the son and SEC the holy ‘demon’.

Before we proceed, there are two promises I would like to make: firstly, I promise that the reader, be it a Menzgold clients or otherwise, will not be stigmatized whiles performing some of the basic arithmetic we intend to conduct. (https://citinewsroom.com/2018/10/11/high-profile-menzgold-customers-silent-due-to-stigma-customers-reveal/). Secondly, and as prophesied by Rev. Nigel Gaisie, the spiritual force(s) in Ghana plotting to attack and destroy NAM1’s business and image will flee by the end of this discussion (https://youtu.be/gpqDb0lHCgI?t=595) .

To begin with, please pull out your “aurum utallium” contract whiles avoiding the stigma of being caught by onlookers as this could be your only last and ultimate intimacy with that contract and an end to your shift in blame games. Subsequently, you could get yourself a gold price chart indicating the prices of gold dating from the last five or so years of Menzgold’s operation and thus from January 2013 to 13th September 2018. You could, however, spare yourself that headache by following the link and or graph attached below without you getting distracted by the ‘epitome of grace building’, alias the gold bullion house – Menzgold’s luxurious East Legon office.

The Archimedes in NAM1 and Misconception Surrounding Menzgold

Let’s then remind ourselves of the key component of profit which is revenue and cost. To be more specific, I presume we all know that revenue less cost will give us our profit and that to derive our profit margin, all we need to do is to divide this profit by the revenue and then multiply the outcome by 100%. Mathematically, we may opt to express it as follows: profit margin = 100 * (revenue - costs) / revenue. Permit me to borrow the words of Michael Dapaah in doing some “quick maths”: let’s presume you bought 20 ounces of gold from Brews Marketing Consult and then took it to Menzgold for it to be traded on your behalf. You may agree that the only thing that will never change in the trade is the quantity you have traded. But for Menzgold to get a good return on your gold, it would have to sell it at a price higher than that at which you bought yours. So basically, you may agree that in the above-stipulated formula, the quantity may never change and hence profit margin would be most dependent on the given price(s).

I believe by now some readers are clearing the misconception in the “NAM-maths” that convinced them to rally against the SEC and the government. Specifically, the misconception that the more people join hands in trading with Menzgold, the higher the return as there is power in mass gold deposits. Ultimately, what Menzgold would reap in return is dependent on a given gold price at a given point in time.

Gold Price Chart Exposes NAM1 and Menzgold?

Source: https://www.apmex.com/spotprices/gold-price

It is about time you took your focus off the aeroplane, the contribution to the Chief Imam educational fund and to the Ghana Premier League sponsorship package and rather focus on the gold chat you have in front of you. Presuming you bought your gold on the 7th of January 2013 when the gold price was highest and worth $1,680 per ounce you would see there is no point in time that price will favour your gold trade since any attempt would put you and Menzgold at a loss. You would thus side with me that to reap a maximum profit, Menzgold would have to buy the gold from you at a time when there is a dip in price and then resell it to its partners at a time when prices have shot to a good maximum.

The only highly favourable examples in the whole of Menzgold’s active operational days are as follows: on the 27th of June 2013 ($ 1,225.4 per ounce) and on 28th August 2013 ($1,420.8) – a 2-months gap, on the 31st of December 2013 ($ 1,206.3 per ounce) and on 14th March 2014 ($ 1, 381 per ounce) – a 3- months gap and on 21st December 2016 ($1,133.7 per ounce) as against that of 5th September 2017 ($1, 341.9 per ounce) – a 9-months gap. These four periods could be seen on the graph with some coloured lines, one pointing to the bottom and the other to the apex of the price trend in the four given periods. Finally, the period in which Menzgold would have been expected to make a “huge” return on sales and possibly profit margin is on the 2nd of December 2015 ($1, 057.1 per ounce) as against that of 8th July 2016 ($ 1, 362.3 per ounce) - a 7 months’ period (please see the area marked with the light green line).

Correspondingly, Menzgold could reap in those favourable periods: 13.8% profit margin over a 2-months period or roughly 6.9% a month, 12.6 % over a three-month period or roughly 4.2% per month, 15.5% over a 9-month period or roughly 1.72% over per month and finally, a 22.4 % profit margin over a 6-month period and thus 3.73% per month. Please refer to the formula if you so please.

Now assuming Menzgold did even trade your aurum utallium in one of gold trade’s booming periods and thus when it is expected to make a 6.9% per month gross profit, how is it then that Menzgold is able to pay you a 7-12% per month dividend when you have been rightfully informed that business isn’t a thing for the pope? Would Menzgold be a sacrificial lamb whiles you sip your tea at its expense? Have you also realised this is just but the gross profit and not the net profit? Yes, you are right! Expenses in the likes of staff salary, transport fares, taxes on gold sales and others are yet to be taken into consideration. If those are to be deducted from the gross profit, for sure, these margins could even plummet way below the ones stipulated above. Mr. Opare Hammond, the managing director of the Precious Mineral Marketing Commission’s (PMMC) was perhaps right when he boldy stated that the maximum return a gold dealership firm could make on gold trade is slightly above 1% and a max of 3% (https://youtu.be/MmkiROkOmmw?t=568). But Mr. Opare Hammond, you too, what if NAM1 traded on the ‘Walewale’ or the ‘Kasoa’ gold market and not on the London gold market or the Dubai one?

Besides the aforesaid periods and their corresponding margins, you could at a glance deduce that at any given point in time Menzgold CANNOT make any substantial profit-margin beyond those listed above here, unless for sure “Namchimedes” has the Midas touch or is perhaps a major prophet like Eagle prophet whose father could make his hair turn all grey within a span of 12 hours (https://youtu.be/p0w0iRYSA6c?t=2062) . To be more specific, for Menzgold to reap any of these gross profit margin ranges (between 3% - 7%), it would have to know that prices will shoot up in any of the days listed above. Otherwise, it is just bounded to make nothing but a loss or a figure below the 3% indicated in those booming days. Like this author rightfully said in the previous writing, your aurum returns are determined by demand and supply and not by a psychologist, an economist, an environmental and mining scientist, an African and world historian and a lawyer (https://www.ghpage.com/personality-profile-zylofon-boss-nana-appiah-mensah/33748/)

At this point in time, you could decide to make the calculations yourself. Pick any three-given month during your days of affiliation with Menzgold whiles taking note of the gold price at the time at which prices fell the most and compare it with that at which it blossomed the most. Whiles applying the aforesaid formula, try to calculate your gross profit margin and if you make anything above 6.9%, kindly ‘dm’ me on Instagram so we together celebrate this author’s stupidity. But you the reader, or a relative of yours who is probably still standing with Menzgold would have to, at the all point in time, go in for a monthly dividend even in those days on which gold trade are less favourable for Menzgold. Now remember, if Menzgold traded at all on your behalf during some of the months you showed up for your returns, it would have incurred either a loss or a profit of below 3%. So, the big question is how then is it possible to keep up with a promise of a constant 7% - 12% per month profit margin, when it was in all cases, not able to make above a 7% profit?

Your guess could be as good as mine. Couldn’t it be that it would make things easier by taking from Peter and paying the same Peter or perhaps Paul? If that be the case, then you are right. That is what some of us have been saying all along and thus Menzgold is a Ponzi Scheme. Oh no! Lest I forget, what if it is investing in the likes of Kumi Guitar who would subsequently play concerts to make up for the remaining 7%+ per month? Well, I am being told NAM1 might have been investing in forex trade alongside. If that be the case, then firstly, I would say there is a bad faith between the two parties of my aurum utallium contract because I signed up to trade in gold and nothing but gold. Secondly, I would then do a similar calculation with the prices of the forex products and may also be found wanting as the hard reality is that things are not any different on that market too.

The call on the ‘Nogokpo’ priests

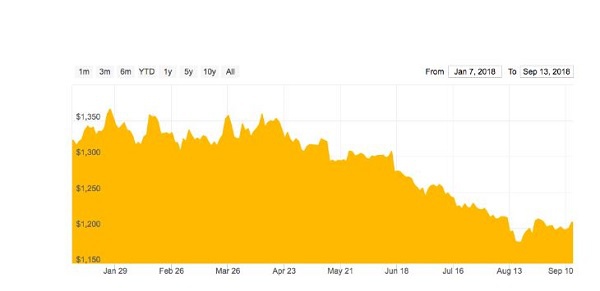

Before I sign out, would you wish to have a glance at the gold prices for the year 2018? Please don’t judge me wrong. I have been in your shoes before and when I took a glance at the fluctuating price trend in a Ponzi product from which I was lucky to have escaped, I nearly dialled the numbers of the “almighty” Nogokpo priest. By the way, the decline in gold prices in the year 2018 was more horrific than what was seen on the earlier graph. The prices seem to almost suggest there’s virtually NO WAY of making even a 2% a month profit (please see below). Once again, Mr. Opare Hammond was right with his statement that it is a financial impossibility to make above a 3-% profit margin. But just in case your calculations suggest otherwise, please feel free to contact me on Facebook, on Instagram or at worse I will do my best to twit you to stay calm at 22:15.

Source: https://www.apmex.com/spotprices/gold-price

Finally, Ponzi was right to quote in his autobiography that “people never refuse what does not cost them anything. It's human nature all over. But they would have no earthly use for my publication unless, they could read it. Therefore, it would have to be printed in various languages. Not in all of them. English, French, Italian, German, Spanish and Portuguese would have been enough” (C. Ponzi, 1920 pp. 57 in “the rise and fall of Mr. Ponzi). In our case, Twi, Ewe and Ga would have been enough. I, however, hope some of us have rightfully learnt a lesson from this and would go to every angle to ascertain the legitimacy behind every single proposal presented to us. And hopefully, we would have learnt by now that we are the first culprit for failing to cross-check facts prior to pending our signatures to the contract.

Lastly, without mincing words, we may side with the Washington Evening Star Newspaper’s description of Ponzi and apply same to describe our home-grown financial genius – NAM1 and thus “whether he retires a millionaire or is finally detected as a swindler, he must stand as a remarkable figure” and “it must be said of him that whatever his game, he has certainly played it well” (C. Ponzi, 1920 pp. 4 in “The Rise and Fall of Mr. Ponzi).

Author: Martin Luther Akor