Opinions of Friday, 6 July 2018

Columnist: Seth Terkper

Will 2018 mid-year review settle GH¢7billion liability question?

In presenting the 2017 Budget, the Minister for Finance stated that the previous National Democratic Congress (NDC) administration had left significant ‘arrears’ of about GH¢7 billion to be settled, hence, increasing the budget deficit (on cash basis) to 6.3 per cent of GDP.

This was stated in paragraphs seven and eight of the 2017 Budget Statement.

Other figures cited are GH¢11 billion and GH¢5 billion while the Auditor-General disclosed GH¢11 billion (liability) and GH¢6.3 billion (certified) in a Special Audit Report to Parliament (ref: Report of the Auditor-General on the Liabilities of Ministries, Departments, and Agencies (MDAs) as of 31 December 2016). The IMF also uses these figures in various reports under the ECF Programme.

After both the 2017 Budget and Audit Report, I explained, as did the Minority (Finance Committee) in Parliament, that these figures gave an erroneous view of the fiscal position.

This is because these were engaged in a special exercise of moving Ghana from ‘cash accounting’ to ‘semi-accrual’ basis as part of the Ghana Integrated Financial Management System (GIFMIS) reforms.

This requires that our fiscal accounts go beyond the current definition of ‘arrears’.

The figures being cited were compiled by MDAs to comply with Appendix 7 of the 2017 Budget Guidelines, which I signed in office in February 2016 for the 2017 Budget Hearings.

Table 1: List of MDA/MMDA liabilities (As Appendix 7: Template for Outstanding Commitments and Arrears, 2017 Budget Guidelines, issued in February 2016)

1/ NOTE: BALANCE ON CONTRACT=TOTAL CONTRACT SUM (REVISED/ORIGINAL) + PAYMENTS

Table 1 is ‘blank’ because the 2017 Budget omits details of such vital data but it seems to form the basis for the special audit.

We quote from the Auditor-General’s report, issued on January 23, 2018 (Executive Summary, page 1), to support the assertion that the previous administration was transparent with the exercise.

“The 2017 budget hearings disclosed that there existed within MDAs several outstanding commitments running into billions of Ghana cedis” (emphasis added).

Since the 2017 Budget Hearings were part of fiscal year (FY) 2016 activity, any allusion to non-disclosure or fiscal indiscipline, more importantly, the large ‘liability’ classified as ‘arrears’ now seems to necessitate the unorthodox offsets discussed in this article.

The essence of Tables 1 and 3 (below) is that ‘arrears’ are a smaller component of commitments or liabilities, arising from a ‘pipeline’ beginning with the award of contracts, including multi-year projects.

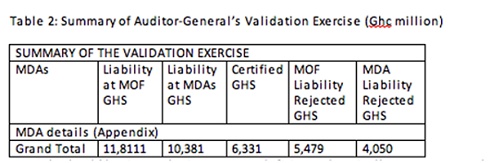

Table 2 (Audit Report, p. 2) does not use the Budget Guidelines format in Table 1 but it is sufficient to proceed with the analysis.

Table 2: Summary of Auditor-General’s Validation Exercise (GH¢ million)

The ‘cash’ basis results in narrower deficits and, typically, equates MDA ‘arrears’ to three to six months of unpaid bills held at MoF (now on GIFMIS).

In contrast, ‘semi-accrual’ expands MDA ‘liabilities’ to cover executed contracts or part thereof called ‘certified.’

The guidance for ‘arrears’ is from the IMF ECF Programme (which has not changed since the negotiation of the Programme: ref—IMF Board Papers, 2014 to date).

Table 3: Summary of components of “arrears”

The Audit Service did not refer explicitly to these criteria in the Special Audit Report and its “Summary Report of the Validation Exercise” (p. 2) covers MDAs, not the other four classifications in Table 3.

Secondly, in many instances in Appendix A (i.e., details for each contractor), the Audit Report equates ‘Liability at MoF’ to ‘Liability at MDA’—not consistent with the definition of “arrears”.

These suggest that the service did not use the ‘pipeline’ implied in Table 1, where claims may be fully- or partly-certified at an MDA but not submitted to MOF (entered in GIFMIS) to start the counting of ‘arrears.’

Finally, the Ministry of Roads and Highways and that of Energy were among the ministries with the largest amounts. It is for this very reason that the Energy Sector Levy Act (ESLA) was passed.

Often, budgets disclose ad hoc or exceptional “arrears”, due mainly to policy misalignments (e.g., subsidy and Single Spine wage arrears). These would be routine under the envisaged GIFMIS/PFM ‘semi-accrual’ reforms to avoid perennial budget overruns — through MoF (a) having better control of all MDA ‘liabilities’; and (b) improving processes, in line with our Middle-Income Country (MIC) status. Consequently, the 2017 Budget Guidelines (Appendix 8) also reproduced the Chart of Accounts (COA) as guidance for the transition to ‘semi-accrual,’ including codes for GIFMIS Accounts Payable and Receivable modules.

Points to note:

i) Arrears: The amount of US$6.3 billion is “certified” claims from total MDA liability of GH¢10.4 billion—excluding items that fall under the three to six months of unpaid bills in Table 3. The Auditor-General was assessing general liabilities, not validating ‘arrears,’ as used by the Minister of Finance.

ii) Road and energy-sector arrears: Government passed the ESLA, which covers road and energy arrears but these asset accounts are not offset against relevant MDA claims in the Audit exercise.

Treatment of GH¢7 billion in 2017 Budget and Fiscal Tables

The second main point is that despite claims by the government, the minister did not bring forward the so-called GH¢7 billion ‘arrears for liquidation. The Budget merely made several “offsets” and “changes” to make the figure neutral from FY2017 onwards.

As shown in Tables 4 to 6 below, the 2017 Budget appears to use a form of ‘financial accounting’ as has never occurred in our fiscal records.

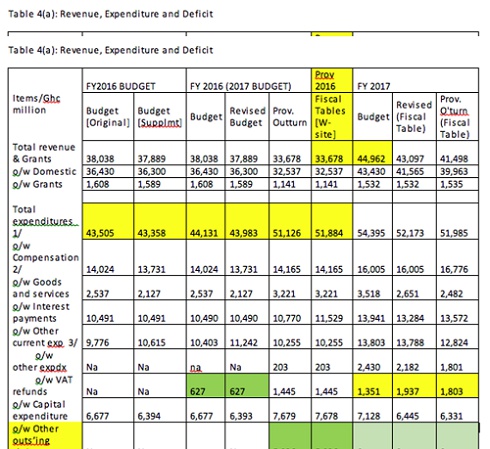

Table 4(a): Revenue, Expenditure and Deficit

Points to note:

i) Parliament: Some changes in the 2017 Budget and fiscal tables were approved by Parliament and should not change.

ii) ‘Claims’ as cash payment: The distinct figure of GH¢5,036 million in Table 4(a) is an “outstanding claim” (i.e., liability or arrears), not a “cash” payment to be shown above-the-line. This is an anomaly since all items above-the-line are either cash ‘receipts’ or ‘payments’ under conventional ‘cash’ —and even ‘accrual’—accounting rules.

iii) Unusual offsets: As argued in Table 4(b) below, this anomaly is equal to ‘offsets’ made below the line as positives, not negatives..

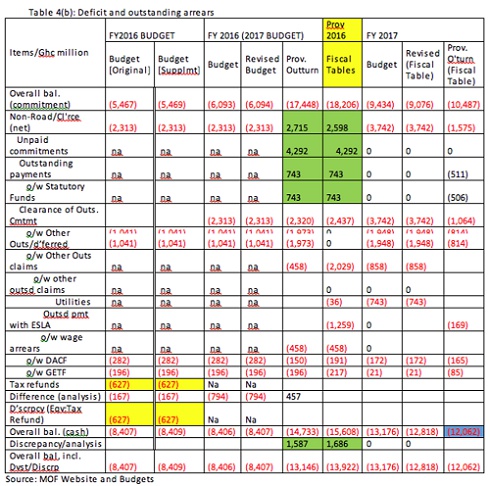

Table 4(b): Deficit and outstanding arrears

Points to note:

i) Positive ‘arrears’: It is unusual to show claims or arrears as ‘positive’ balances in Table 4(b) since they are meant to increase the deficit from Table 4a.

ii) Overall ‘Cash’ and ‘Commitment’ balances: Another anomaly is with overall ‘cash’ balance of GH¢13,146 million being lower than the overall ‘commitment’ balance of GH¢17,448 million

iii) Discrepancy: A large ‘positive’ discrepancy of GH¢1.6 billion is needed to achieve the desired overall ‘cash’ balance of GH¢63.1 billion. Moreover, there are differences between some budget items and the tables published on the MOF website.

In summary, we either see ‘offsets’ or ‘netting’ that result in two (2) positives in Table 5(b)— GH¢4,292 and GH¢743 million that are equal to the GH¢5,036 million in Table 4(a).

A) Treatment of GH¢7 billion ‘arrears’ in FY2017 and 2018 Budgets

Tables 5(a) and 5(b) show the unique dropping of the ‘positive’ offsets in FY2017 and 2018—not as explicit negative balances carried forward that results in a plan for ‘arrears clearance’ in budgets or requirement in IMF Programmes (e.g., Single Spine wage arrears).

Points to note:

i) The ‘positive’ arrears balance of GH¢2,598 million (GH¢2,715 million) for FY2017 becomes ‘negative’ of GH¢3,742 million. For this to happen, a huge negative offset of GH¢6,340 million or GH¢6.3 billion is required.

ii) Curiously, a lower amount of only GH¢4,290 million is required to achieve a tighter overall balance of GH¢1,575.

The fiscal tables show that these “positives” items have not occurred in MoF data that is available from FY2000.

B) Background to compilation of Appendix 7

We make the following additional points to show that the data and classifications in Appendices 7 was strategic and planned, not ad hoc or secretive, with a goal of moving the nation to ‘semi-accrual’ accounting.

a) Contract Database: Appendix 7 (Table 1) is based on the form for the contract database that was set up in 2010 and initially funded by GIZ and DFID. This is part of the goal of replacing the cash basis with semi-accrual under the PFM/GIFMIS reforms.

b) Cabinet and Parliamentary approvals as captured in the 2014 and 2015 budgets to support the shift to “semi-accrual” or “commitment” accounting basis.

c) Adoption of International Public-Sector Accounting Standard (IPSAS): In the 2015 Budget, the Controller and Accountant-General and Institute of Chartered Accountants, Ghana (ICAG) were requested to formally adopt IPSAS for public sector accounting—similar to using the International Financial Reporting Standards (IFRS) as official basis for preparing financial statements by the private sector.

d) GIFMIS modules: The shift to accrual accounting has been a major goal of GIFMIS project since 2010. The project is funded by the World Bank and some Development Partners (DPs). The Appendix 7 compilation was meant to support implementation of the Accounts Payable and Accounts Receivable modules from 2017.

e) Disclosure in “Home-Grown” and IMF Programmes: These Programmes specify the shift to accrual accounting as important policies in the Letter of Intent (LOI) and Memorandum of Economic and Financial Policy (MEFP).

The non-disclosure of all commitments or liabilities is a major source of budget overruns and the delay in implementation is due to the exclusion of the contract database from Phase II of the GIFMIS financing by the World Bank. The goal of Table 1 is to disclose three (3) levels of liabilities, including:

(a) Contract sum: The potential amount that Government owes upon signing a contract or supply agreement, which commits government to pay upon completion of a contract or supply. This amount is useful in the context of the rolling 3-year Medium-Term Expenditure Framework (MTEF).

a) Commitments: These are unpaid certified amounts of completed contracts or supplies at MDAs, MMDAs, and MOF. This partial or exceptional amount is added to “outstanding” claims in the budget, with multi-year payments plans, including road, wages (e.g., Single Spine), statutory funds, and subsidy arrears.

b) Arrears: This is compiled from Table 2 above and, in general, is equivalent to 3-to-6 months of unpaid bills submitted to MOF by MDAs through the GIFMIS platform.

Arrears are useful for liquidity management but not effective for sustainable control of budget overruns, even with a partial commitment list and clearance plan.

Hence, countries move to a more comprehensive “commitment” or “semi-accrual” basis with a formal “ledger” regime that forms the background of the GIFMIS Accounts Payable and Receivable modules.

C) Conclusion

Contrary to the view that the Government is actually paying down the much-trumpeted GH¢7 billion, it seem to implement a “plan of offsets” to the amount neutral in the 2017 Budget. These financial changes amounts to either

• a retrogressive move to revert to the “cash” basis and, hence, stem or delay the move to “semi-accrual” accounting; and

• buy time to settle the arrears gradually, with funds from sources such as the ESLA (energy and roads), to avoid giving the credit to the NDC, as happened with the quiet payment of the balance of US$250 million from the Sinking Fund.

The Minister must clarify the true position of arrears or commitments in the forthcoming mid-Year Review. The gradual shift to semi-accrual accounting is a structural measure that should not consist of capricious adjustments to the end-2016 Provisional Budget Outturn alone—as repetitive debits (negatives) and credits (positives) designed to achieve political goals.

The Controller and Accountant-General must show consistency in distinguishing between the conventional cash basis and accrual basis—which is an important principle in accounting. The Service must avoid undue discretion in the method used to prepare the Budget and Audited Public Accounts that is presented to Parliament.

We call on the Finance and Public Accounts Committees of the House take to due note of the changes made to the Budget and the Public Accounts for 2016.

Finally, we call on the Institute of Chartered Accountants, Ghana (ICAG) to assume its leadership role and complete the approval of IPSAS for use in the public sector and examine the ethical and professional grounds for some of the issues raised.